DACX

artificial intelligence and high-performance computing technology

Since its inception, DACX has gone a long way, our MVP was launched in January 2019, where the team made the decision not to seek external funding for the project at an early stage. This has proven to be influential in driving:

- An independent environment that enables clearer strategy and development

- Creativity & innovation are accelerated and at stake

- Get more attention from our customers.

This allows the organization to stay focused and remain relevant with respect to changes in the regulatory landscape and investor tastes for ICO. During this journey we have made progress not only on the product side but also in the blockchain community by forming affiliations and working relationships with established organizations in this space. On the regulatory side, as a centralized exchange with the aim of registering STOs in the near future, it is in our interest to design compliance in the core of our architecture to reduce regulatory risks now and in the future. Therefore, our platform integrates KYC, AMM and AML to monitor real-time risk which reduces suspicious market behavior.By sending our cross-border testing proposal to the main consortium of FCA regulators, which is officially known as GFIN (Global Financial Innovation Network). DACX is one of eight successful companies selected to become pilots. Our proposal requires the use of DLT and machine learning to facilitate cross-border transactions in multi-currency, asset and commodity payments through smart tokens, contracts and escrow. This will be an ongoing journey where DACX intends to write standards for quality and achievement in the sector, and on 23 September 2019 we will open registration for incoming clients (see 3.11 for the Affiliate / Reference Program).DACX’s vision and goals are very high, and as such, its achievements require partnership and affiliation. This partnership is in the blockchain community and has helped in the fantastic steps DACX has produced. One of these goals is to enter STO. For this result, DACX fully incorporates design compliance based on the structure of the work to stop future regulatory problems.This business also involves transportation applications. So partnering with some of these infrastructure suppliers provides access to applications such as the machinery fitting trade. This program can help make the best orders, offers and offers. The performance of this trading machine depends on complex algorithms. This algorithm uses a multi-threaded procedure, which is very difficult to find. The combination of effective trading options is the reason DACX can cover more than ten thousand trades in 1 second.

DACX CHANGES

New technology enables global businesses to reach new audiences around the world to ensure a path for international clients now than ever before. Organizations have been hampered by not ensuring that multi-lingual support is part of an ongoing strategy, customers must always be at the core of your business goals, and part of this gives them a seamless experience. Multilingual help desk, whether at home or obtained through an outsourcing company is key as the product grows. A trade matching machine is software that is used to match purchase orders, offers, and with sell orders, offers. This is the most important part of every exchange because that is what allows users to trade with each other and all the reasons why they are registered on the platform. A suitable trading machine follows an algorithm that determines the set of rules they must obey, how it works, how many orders can they deal with how many pairs and how long. The multi-thread process is more profitable, but only a few crypto exchanges implement it because it requires more work, experience and time to build.Therefore, he partnered with Modulus Global infrastructure provider, Modulus, a twenty-year-old developer specializing in HPC and financial technology, and has provided sophisticated technology products and services to clients including the NASDAQ Stock Market, JP Morgan Chase, Bank of America, Credit Suisse, Barclays Capital, Goldman Sachs, Merrill Lynch, Fidelity, TD Ameritrade, Devon Energy, IBM, Microsoft !, Google! Cisco, Adobe, the Ford Motor Company, SAS Institute, Rutgers University, University of Chicago, MIT, Oak Ridge National Laboratory, NASA, and thousands of companies, education, government and other non-profit institutions, in 94 countries since 1997.Their high-frequency trading solution, allows DACX to provide ten million transactions per second from the start and can be increased up to 8X if and when needed. In comparison, Bitfinex can handle around one million transactions per second, and Binance is only a little more – around 1.4 million. With latency as low as 40 nanoseconds, your portfolio can now go up and down 1.5 billion times in one minute. Even NASDAQ, with latency of 400 microseconds is 10 times slower. Unlike Nasdaq SMART, Modulus solutions track money laundering on crypto exchanges. Our system uses a deep learning neural network to identify hidden relationships in exchange and even in the blockchain.# SecurityTo ensure the security of digital assets in our custody, we use four types of crypto wallets:

- Hot Wallet: This is a wallet that is stored on our internal servers for frequent transfers. Only a small portion of the funds will be saved for frequent transfers. All Hot Wallets come in encrypted form and the decryption key is only applied by authorized personnel at predetermined intervals to approve outgoing transactions. This prevents the loss of assets if our internal server is compromised.

- HSM Protected Semi-Cold Wallet: This is an outdoor office wallet that is owned by all corporate hardware wallet solutions with governance, multisig, and access limits imposed by the Hardware Security Machine. Some signatures from authorized personnel are required to approve transactions and limited access to the private network terminal.

- Hardware Wallet Integration: Comments on integration of Ledger hardware wallet, and X (with pictures)

- Cold Wallet: This wallet is kept offline and transactions are signed on an offline computer by senior management executives.

The advantage1. The exchange fulfills all regulatory requirements, because it functions properly.2. You can make payments in currencies such as EUR, USD, GPB and so on.3. Not only crypto and fiat assets are presented, but also goods, indices, options, and so on.4. Reliability and security at a high level.5. Processing transactions of up to 10 million per second.6. Control over trading and manipulation happens in real time using machine learningSome of DACX’s main features are, but are not limited to:

- 2FA

- Crypto to Fiat

- Rail & Settlement Banking

- Anti DDOS

- Hardware Wallet Support

- Casting

- MultiSignature Wallet

- Universal Wallet-Remit Cross border payments

- Kartu Debit Virtual

Some challenges are seen in our industry:1. Response time2. Don’t have the answer to that question3. Failure to understand what the customer wants4. Accept responsibility5. Resolution – Leave a customer complaint unresolvedThis can cause many side effects, for example;1. Broken reputation2. Lost business & returning customers3. Lost our best employees4. Lack of respect where the key to winning your customers is treating them with great respect.DACX ExchangeNew technology enables global businesses to reach new audiences around the world to ensure a path for international clients now than ever before. Organizations have been hampered by not ensuring multi-language support is part of an ongoing strategy, customers must always be at the core of your business goals, and part of this gives them a seamless experience.Multilingual help desk, whether at home or obtained through an outsourcing company is key as the product grows. A trade matching machine is software that is used to match purchase orders, offers, and with sell orders, offers. This is the most important part of every exchange because that is what allows users to trade with each other and all the reasons why they are registered on the platform. Trading matching machines follow an algorithm that determines the set of rules they must obey, how it works, how many orders they can handle on how many pairs and how long it will take. Multi-thread processes are more profitable, but only a few crypto exchanges implement them because they require more work, experience,Security1. Hot Wallet This is a wallet that is stored on our internal servers for frequent transfers. Only a small portion of the funds will be saved for frequent transfers. All Hot Wallets come in encrypted form and the decryption key is only applied by authorized personnel at predetermined intervals to approve outgoing transactions. This prevents the loss of assets if our internal server is compromised.2. HSM Semi-Cold Wallet Protected. This wallet is an outdoor office wallet that is held by all enterprise hardware wallet solutions with governance, multisig, and access limits imposed by the Hardware Security Machine. Some signatures from authorized personnel are needed to approve transactions and restrict access to private network terminals.3. Hardware Wallet Integration A comment about the integration of the Ledger nano hardware wallet, and X (with Pictures)4. Cold Wallet This wallet is kept offline and transactions are signed on an offline computer by senior management executives.activeDACX Exchange will list USD coins and stable BTC pairs for all high cap exchange coins and utility tokens. We will make a list by taking input from community members. More coins will be added over time. We generally only add exchange coins and utility tokens that have strong credibility, user base and liquidity. For existing or future projects that wish to be listed on the DACX Foundry for the main offer or for secondary market trading on the DACX Exchange, must achieve the benefits and costs of our promotion list. The DACX Exchange platform is scalable in terms of technological and practical applications, therefore in Q1 2020 we intend to have a phased STO for primary publishing and secondary trading.We will launch the platforms in the following order:1. Coin trading & utility utilities2. Main offer and trade secondary market security tokens3. Crypto Currency Margin Trading4. Trade the Fiat currency margin5. DEFIPlatform supported1. We will provide cross-platform trading clients to:2. Web-based trading client3. Android native client4. iOS native client5. REST API6. Web socketsSome of DACX’s main features are, but are not limited to:

- 2FA

- Crypto to Fiat

- Rail & Settlement Banking

- Anti DDOS

- Hardware Wallet Support

- Casting

- MultiSignature Wallet

- Universal Wallet-Remit Cross border payments

- Kartu Debit Virtual

- Security Token

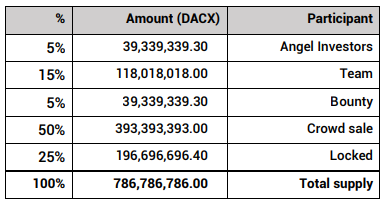

Affiliate / Referral ProgramDACX offers an Affiliate / Referral program to increase brand awareness where prizes are available based on various levels of verification and hold. The total number of DACX prizes is limited to a maximum of 5,000,000 tokens. Token DACX ( DACX )We have released our own service token called DACX Token . This sets a strict limit of 786 786 786 Dacx , which will never increase, and total stock will decrease due to frequent token burns. The DACX token will initially work on the Ethereum blockchain according to the ERC 20 token standard.

Universal Walletuniversal is DACX Remit’s main warehouse . It uses DLT, traditional banking services, and guards to store the following types of assets in one wallet: Fiat Money

- Cryptocurrency

- Service Token

- Token Keamanan (STO)

- Stable coins

- Commodity Token

distribution

DACX Road Map

- September 2019 – pre-registration

- October 2019 – pre-launch DOE

- Q4 2019 – Launch of the exchange

- Q4 2019 – Fiat Gateways

- Q1 2020 – expanding operational jurisdiction in the EU and Asia

- Q1 2020 – cross-border payments

- Q1 2020 – Integration of service stations

- Q1 2020 – Kartu Debit Virtual

- First quarter of 2020 – Bridge Remit & Exchange

- Q2 2020 – trade margin

- Q2 2020 – DEFI – Loans

- Q2 2020 – Extend operational jurisdiction to AN

Tim DACX1 ZISHAN CHODRI: Founder | CEO2. FRANCE CLERKS: Head of Marketing3 LISA LI: Regional Marketing and Communication4 TARIMA ISMAIL: cybersecurity and blockchain engineer5 CURTIS PAVLIK: Regional sales and operations6 JAMES WAKETT: Regional Business Development7 FRASS MASROOR: Complete Stack Developer8. UMAIR JAWAID: DevOps & Platform Engineer9 PETER MACDONALD: Business Strategy and PartnershipAdvisor1. RICHARD GARDNER: CEO Modulus Global2. Lorence KIRK: CEO of Extropy.IO

Conclusions ofExchanges are a source of crypto currencies, so they must be user friendly, provide liquidity for the industry as a whole, and are very safe. The emergence of security tokens will be very large in this space, and once again exchanges that achieve full regulation and compliance will become dominant in the crypto / blockchain arena in the future.For more accurate information, follow the link below:

- Official website: https://dacx.io/

- Telegram: https://t.me/OfficialDacx

- Twitter: https://twitter.com/dacx_io

- Facebook: https://www.facebook.com/dacx.io

- Instagram: https://www.instagram.com/dacx_io/

- LinkedIn: https://www.linkedin.com/mwlite/company/dacx-group

- Medium: https://medium.com/@dacxinc

- Link:https://bitcointalk.org/index.php?action=profile;u=2652067